A small-scale business selling handmade products only accepted bank transfers or cash on delivery and did not offer any digital payments in the beginning. Due to this approach, they faced a lot of problems like:

- Low customer base: Potential customers were discouraged due to a lack of diverse payment options. Some customers preferred using cards or digital wallets for online transactions which they did not offer. The BlueSnap survey states that 48% of businesses have lost up to 10% of their international revenue because their payment processing vendors do not offer the right payment options.

- Payment Delay: Due to bank transfers, there was often a delay in receiving the payment which affected the cash flow. It also made it difficult to manage the inventory.

- Ineffective payment management: Since orders were not automatically linked to payment records, the team had to check for the payments which was time-consuming manually.

- Limited data visibility: The team was unable to analyze which products were selling well and could not track customer purchasing behavior.

- Security concerns: Due to a lack of security, customers were hesitant to buy products and make payments.

Now, what do you think this business could have done right to streamline its financial transactions? Implementing an online payment gateway system and integrating it with CRM software.

But, if you are new to the concept of payment gateways, let’s understand that first and get the basics right.

What are payment gateways

The payment gateways are digital services that enable financial transactions between businesses and customers. They securely transfer payment information from the customer to the merchant’s bank account by acting as intermediaries while also verifying the funds and authenticating transactions.

It also supports various payment methods such as Unified Payments Interface (UPI), credit cards, debit cards, and digital wallets. They encrypt sensitive payment data and ensure that it is transmitted securely between the two parties.

Online payment gateways are an integral part of organizations as they can

Improve customer experience by offering customers a variety of payment options making transactions quick and convenient.

Enhance security by deploying advanced security measures such as encryption to protect sensitive data. It reduces the risk of fraud and other malicious activities building trust and reputation.

Make settlements faster: It facilitates quicker transactions and settlement times ensuring that businesses receive funds quickly.

However, one of the challenges businesses face while solely relying on digital payment services is the lack of integration with CRM software which is often used to manage daily operations. Take a closer look at why CRM payment integration can be a game changer for your business.

Top reasons to consider for CRM payment gateways

No wonder the numerous integrations provided by the CRM application simplify business processes and make selling remarkably easier. Among the countless third-party integrations supported by CRM systems, such as email marketing, social media, and telephony, payment gateways are also included.

Here are some reasons why payment gateway and CRM integration is the ideal choice for your business:

Unified hub for financial transactions

With this integration, you can manage all your sales processes from lead generation to payment collection within a single platform. This can streamline your financial dealings making it more transparent and less prone to errors. Also, you can make or receive payments directly from CRM without opening multiple tabs.

Match your payments with customer records in real-time

By setting up workflows, you can automatically match the payments to customer profiles providing a holistic view of customer interactions and transactions. This can save a significant amount of time and effort allowing you to focus on other complex tasks.

Better financial management

When all information is stored in a single location, you can track and manage your finances seamlessly. This can facilitate in generating robust reports and forecasting revenue helping you to make intelligent decisions.

Highly scalable

The CRM payment gateways can manage an increasing volume of transactions efficiently. It can also accommodate new currencies enabling your business to expand into global markets.

Are you thinking about adopting a CRM that comes with high-end digital payment capabilities? Then we have got you covered.

Vtiger CRM supports different payment gateway integrations such as PayPal, Stripe, Razorpay, and Authorize.Net. But, one integration that we are going to focus on in this blog is Instamojo Integration which specifically caters to Indian businesses.

Vtiger CRM and Instamojo integration

Instamojo is a popular online payment and e-commerce platform based in India. It provides a simple and secure way for businesses or individuals to collect payments and sell products digitally.

In Vtiger CRM, you can leverage its digital payment solution using Vtiger Instamojo Integration. By configuring Instamojo with Vtiger you can:

1) Create payment records from different Vtiger modules such as Payment module, Invoices, and Quick Create. This way, you can easily create important records from any module that you are currently using, allowing for a more streamlined and convenient process.

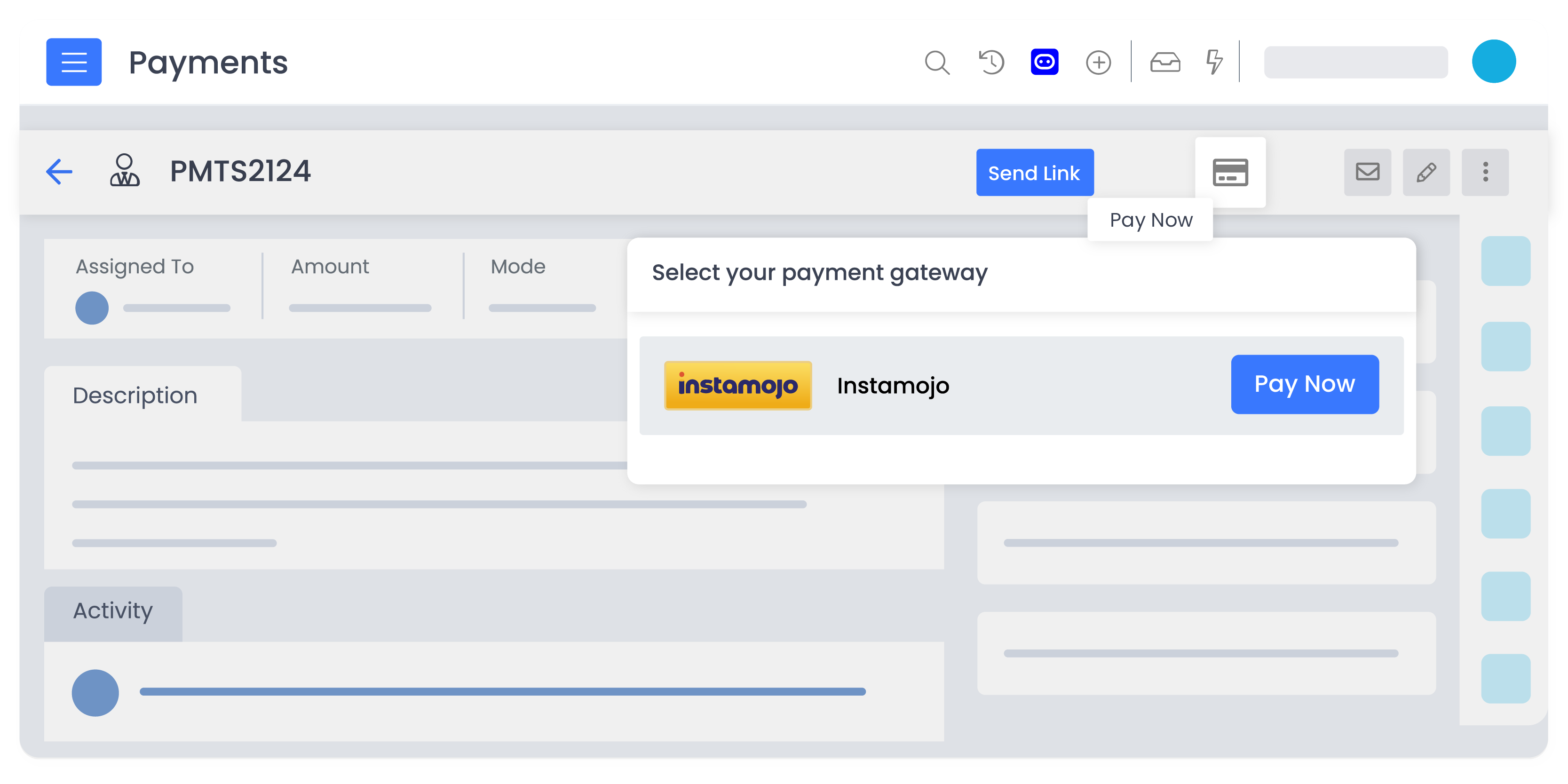

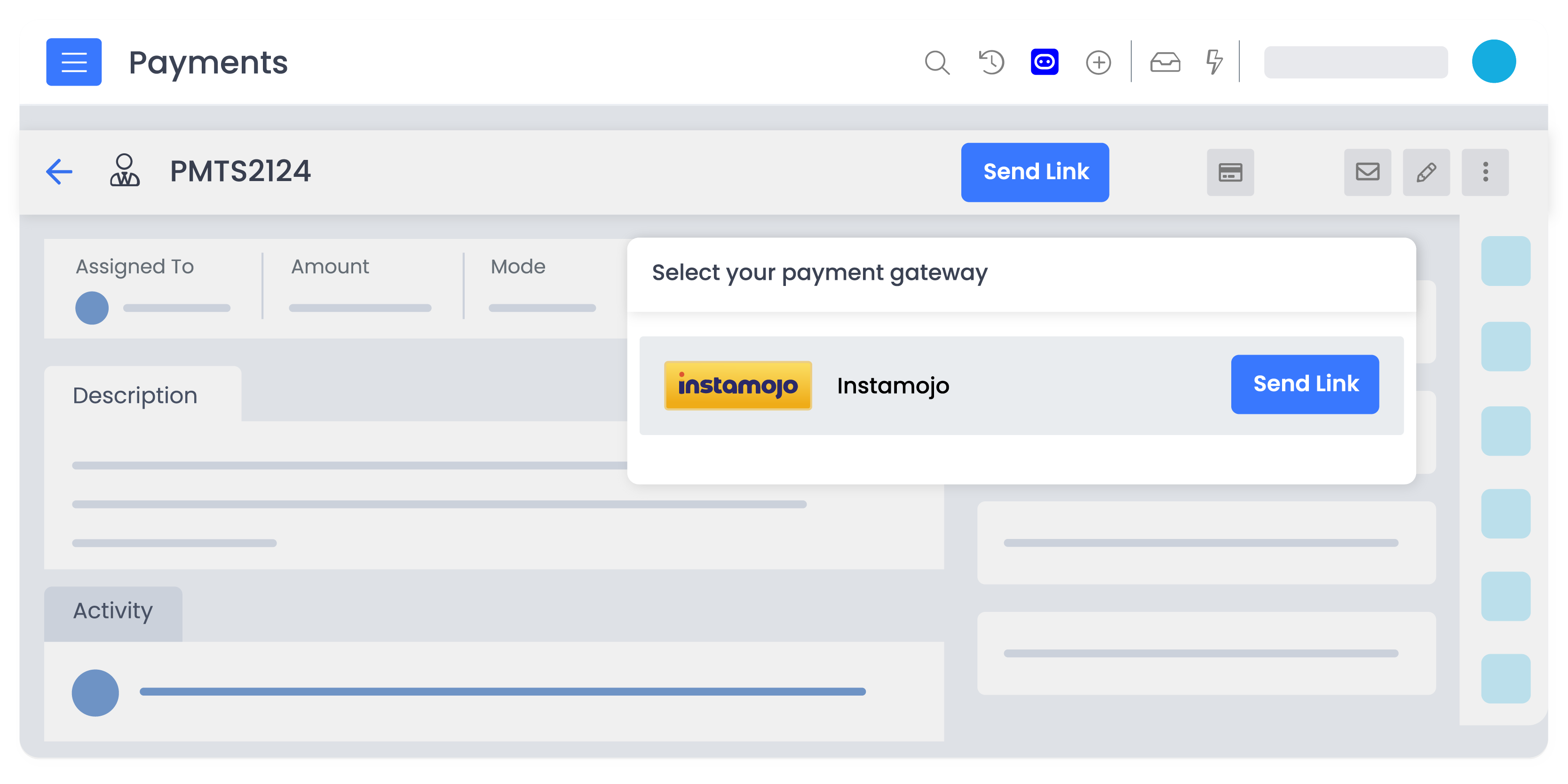

2) Generate payment links directly from your CRM and share them across various channels such as email, social media, or other messaging apps. You can also make payments from a contact summary using PAY NOW option.

3) Vtiger Instamojo integration gives you an option to export the payment record to an Excel sheet and print them out allowing you to maintain a physical copy of all customer transactions.

In a nutshell, Instamojo integration with Vtiger can optimize your business payment processes, delight customers, and drive growth. We encourage you to utilize Vtiger Instamojo and experience the transformation it can bring to your financial management process.